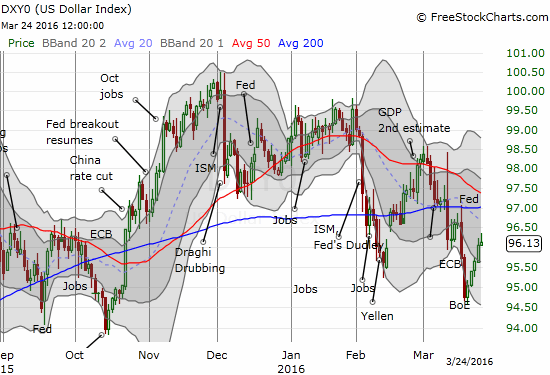

Oil has stayed resilient during the past few weeks, despite occasional risk-off sentiment. Crude prices rose to their highest in three months in early March, at $42.49/barrel for WTI and $42.54/barrel for Brent. This was triggered by a combination of

March 26, 2016