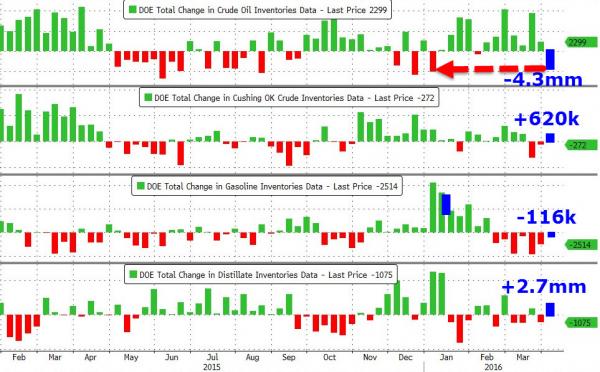

WTI’s ‘mysterious’ spike into the NYMEX close extended after hours (almost as if someone knew something). Inventories drew down 4.6mm barrels according to API (drastically less than the expected 2.85mm build). This is the biggest weekly draw since Jan 1. Cushing

April 5, 2016