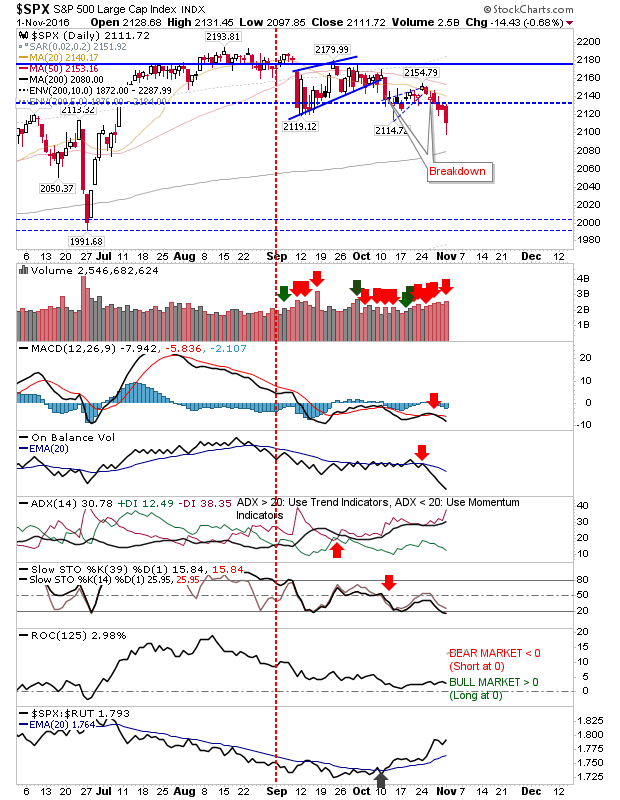

Not since the start of September have Bears been able to make an impression. For many indices, volume climbed to register a distribution day, adding to market troubles. There is no long term damage to markets as they remain within

November 1, 2016

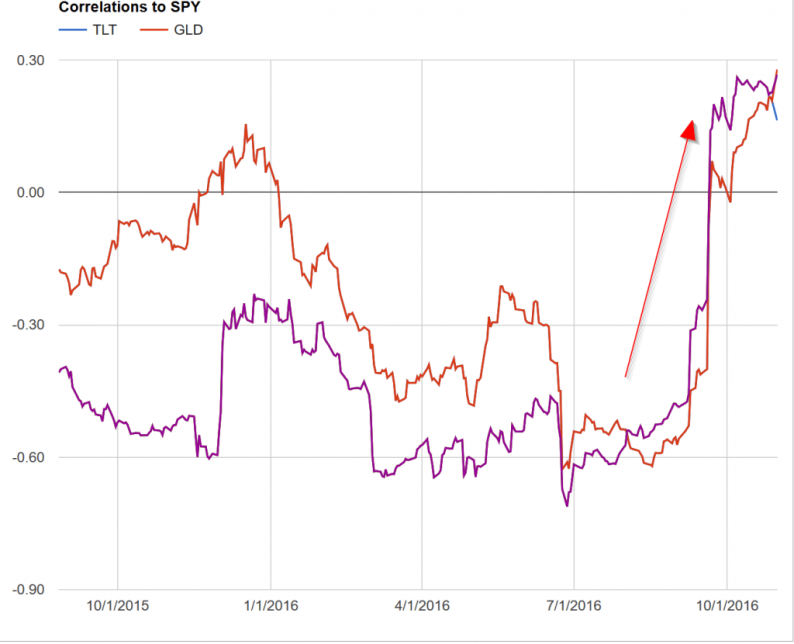

Our top year-to-date strategies: The Maximum Yield strategy with 32.61% return. The Leveraged Universal strategy with 21.42% return. The World Top 4 with 17.66% return. SPY, the S&P500 ETF, returned 5.87%, year-to-date. Market comment: Recent surveys show that fund managers have increased cash positions1 while outflows from equity funds are at