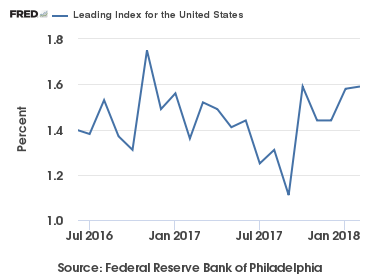

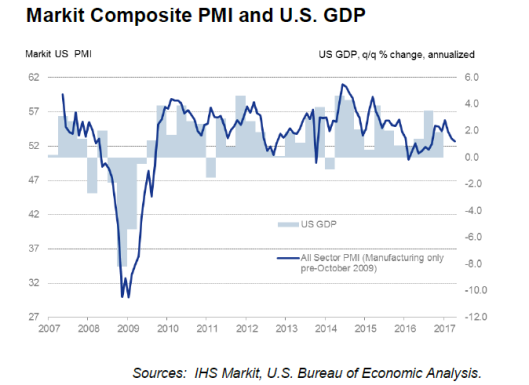

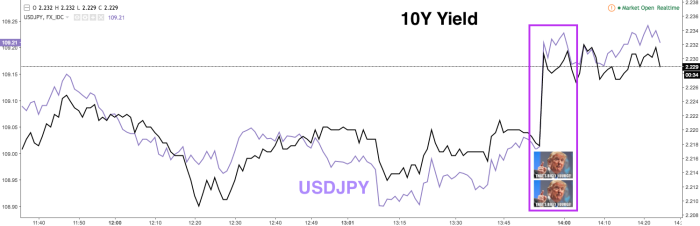

This post is a review of all major leading indicators follows – and their trends are mixed. Analyst Opinion of the Leading Indicator Forecasts Most of the leading indicators are based on factors which are known to have significant backward revisions

April 21, 2017