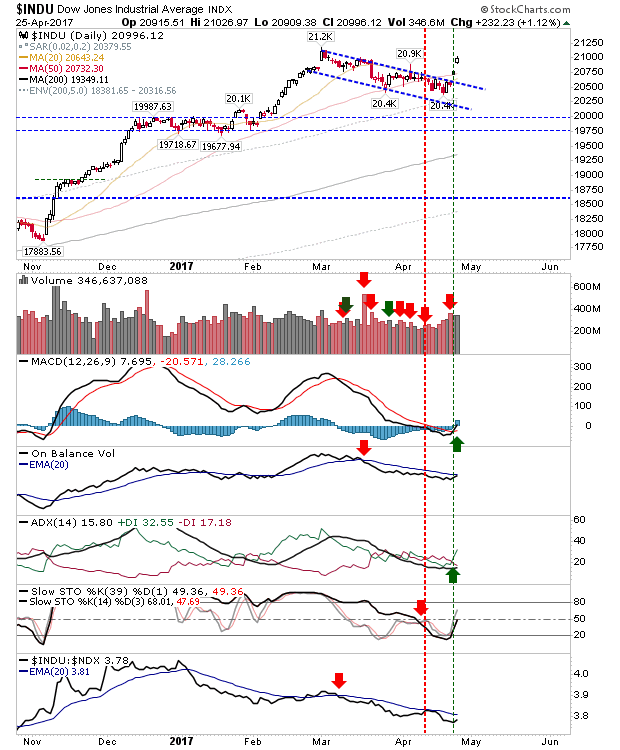

The Dow rallied over 200 points thanks to increased optimism President Donald Trump will be able to push pro-growth economic policies through Congress in 2017. Let’s look at the numbers from Tuesday for the Dow, S&P 500, and Nasdaq: Closing Bell April 25,

April 25, 2017