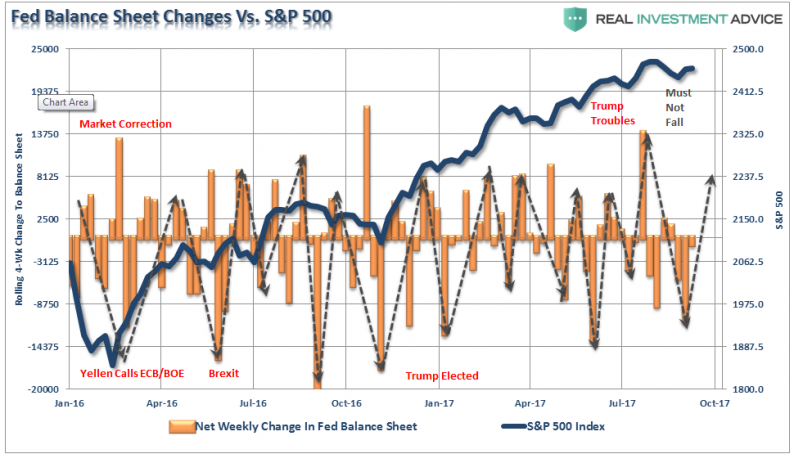

If “missing” inflation is the bane of central bankers’ existence in the post-crisis world, it’s simultaneously the best thing that ever happened to risk assets. Investors are starting to figure out that the best of all possible worlds these days

September 9, 2017