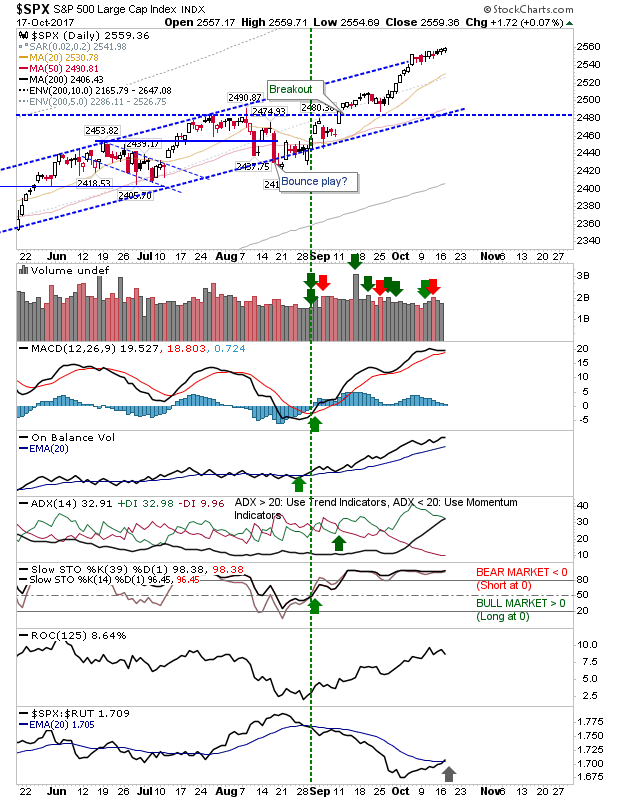

There was little change on the day-to-day machinations of the market. The S&P is riding along upper channel resistance with technicals still bullish. The Nasdaq is caught in a halfway house with bullish technicals and a relative advantage of the

October 17, 2017