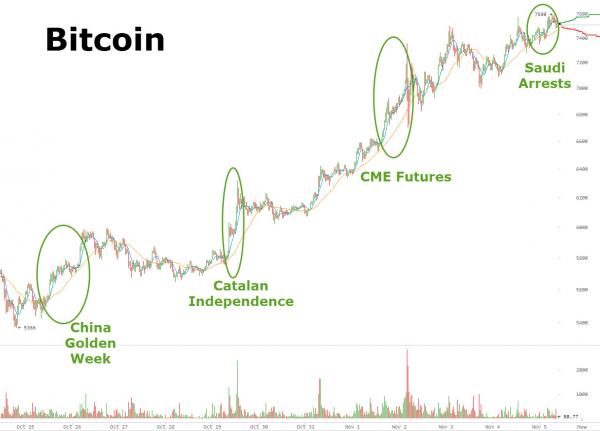

Another crisis in another nation and Bitcoin prices surge to another new high. Overnight chaos in Saudi Arabia has prompted Bitcoin to jump to $7590 – a new record high – ironically as Prince bin-Talal is arrested for money-laundering a week

November 5, 2017