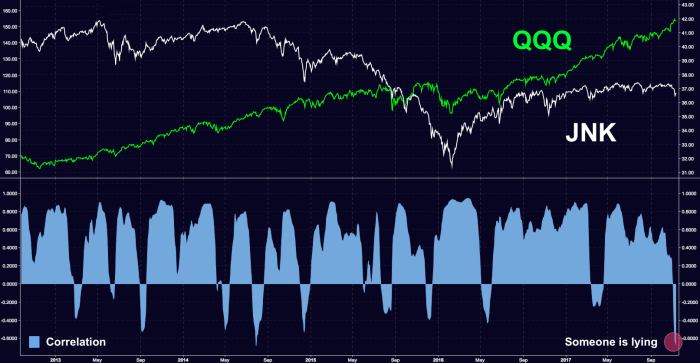

Folks are still scratching their heads about the high yield selloff. Apparently, “it was and still is a bubble” and/or “spreads have become completely disconnected from leverage” are no longer acceptable explanations for mini-corrections. That kind of thinking is no

November 11, 2017

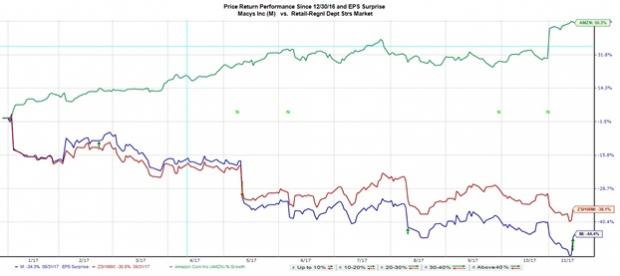

The impressive stock market performance of department store operators like Macy’s (M), Nordstrom (JWN), Kohl’s (KSS), J.C. Penney (JCP) and others over the last three trading sessions in the run up to and following their quarterly releases would suggest that market participants are starting to see ‘green shoots’