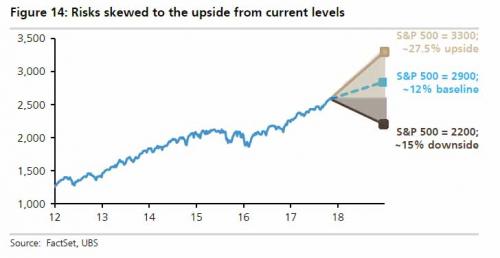

It’s 2018 forecast time for the big banks. With Goldman unveiling its seven Top Trades for 2018 earlier, overnight it was also UBS’ turn to reveal its price targets for the S&P in the coming year, and not surprisingly, the largest Swiss

November 16, 2017