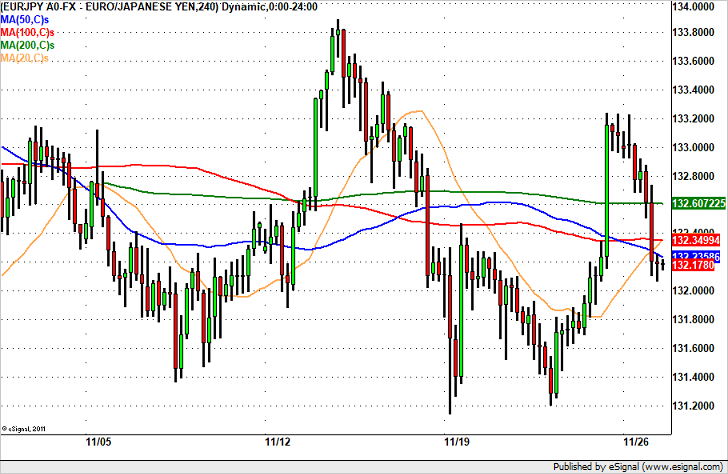

The EUR/USD ended the day at its lows after hitting a high of 1.1961. A reversal as strong as today’s is generally a precursor to further weakness. While it is difficult to say what caused the currency’s underperformance, 1.1975 was

November 27, 2017