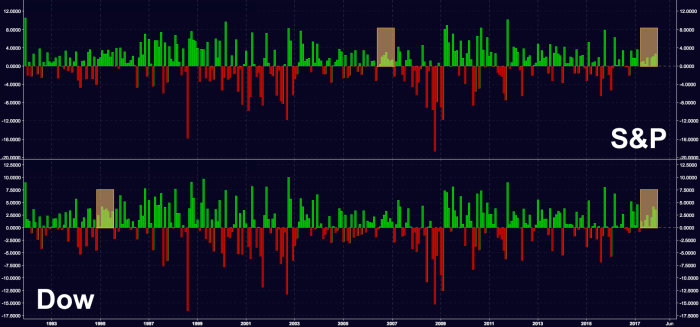

The tech sector took the label of responsibility overnight in Asia for the reason given for most declines. The Hang Seng suffered the most falling near 1.5% following Wednesday price action in the Nasdaq. Even Shanghai lost 0.6% which was

November 30, 2017