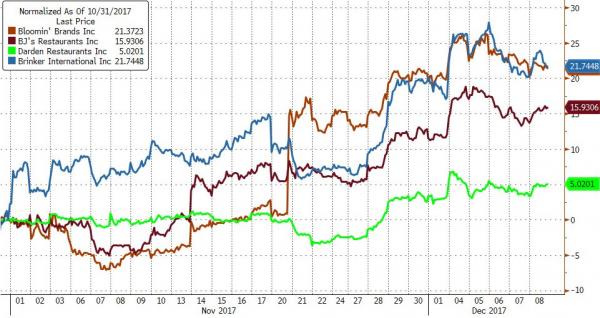

Casual dining investors, despite the retail route, have become increasingly optimistic over the past month and a half with several of the largest names in the industry rallying 15-20% into the holiday season. As TDn2K points out, part of the optimism is

December 9, 2017

The currency market painted a bullish interpretation of the latest monetary policy decision from the Reserve Bank of Australia (RBA). By the time of the September quarter GDP report, that incremental bullishness disappeared and setup a bearish interpretation of the Australian economy. Source: FreeStockCharts.com