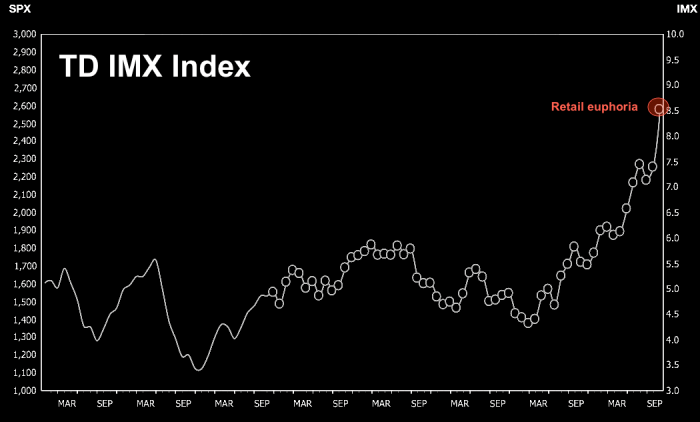

Meanwhile, in more “what could go wrong?” news from the cryptocurrency space, TD Ameritrade is set to allow Bitcoin futures trading starting on Monday. TD boasts the largest futures operation in the online brokerage space, so this clearly has the potential

December 15, 2017