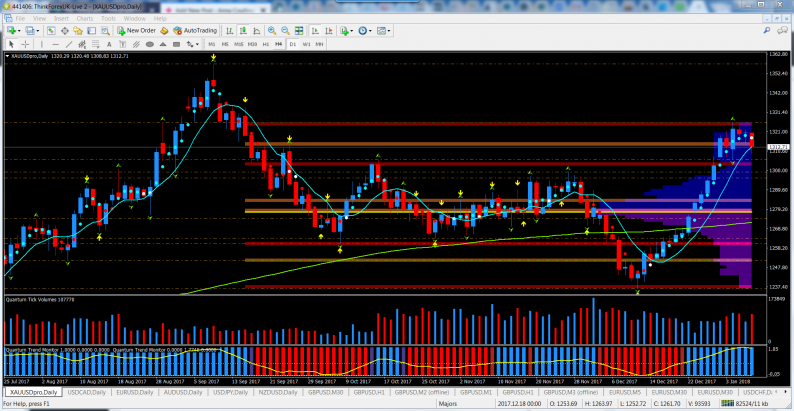

China’s Central Bank hints to have suspended proactive adjustments in the Yuan fixing, a daily reference rate that it issued to the market. On January 9th, the PBOC told that commercial banks, which provide quotes for the Central Bank to

January 9, 2018