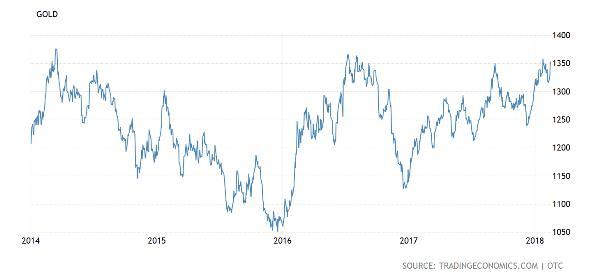

Fundamental Forecast for Gold: Neutral Gold prices continue to consolidate with the January range- constructive above Gold prices are on pace for the largest weekly advance since August and snap a two-week losing streak with the precious metal rallying more 2.8% to

February 17, 2018