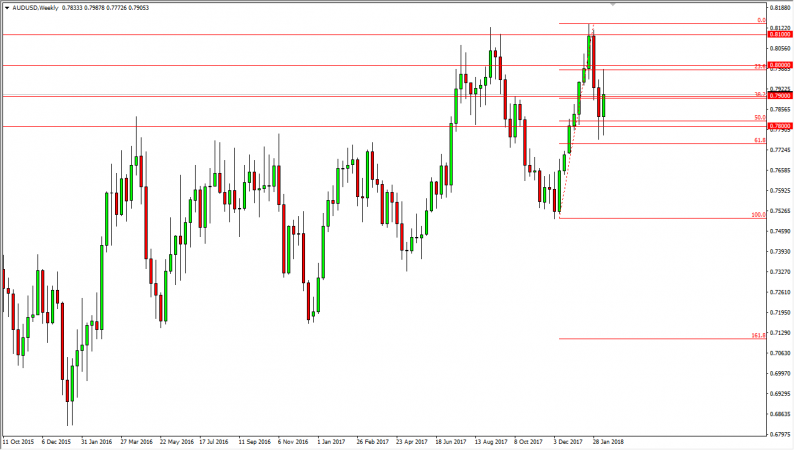

AUD/USD remains in the downtrend from 0.8135, the bounce from 0.7758 is likely a correction of the downtrend. Another fall could be expected to a correction and a breakdown below 0.7758 support could trigger further downside movement towards 0.7500. Near

February 18, 2018