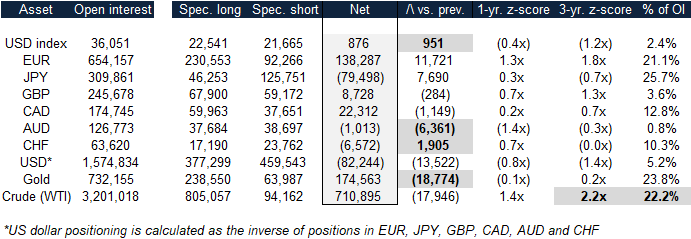

Looking at this week’s Commitments of Traders Report, notable changes include rising net positions in the USD index and the Swiss franc, and falling net positions in the Australian dollar and gold. Similar to last week, the only asset under

March 18, 2018