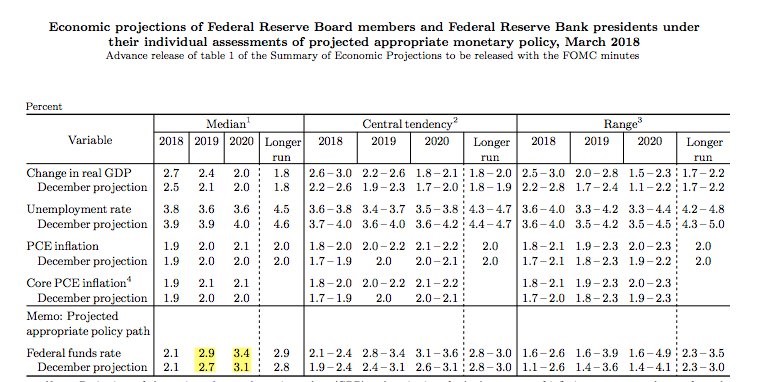

As expected, the Federal Reserve, headed by the new chairman Jerome Powell, raised interest rates for the sixth time since the financial crisis by 0.25% to 1.50-1.75%. The central bank hinted at gradual hikes for this year with two lift-offs

March 22, 2018