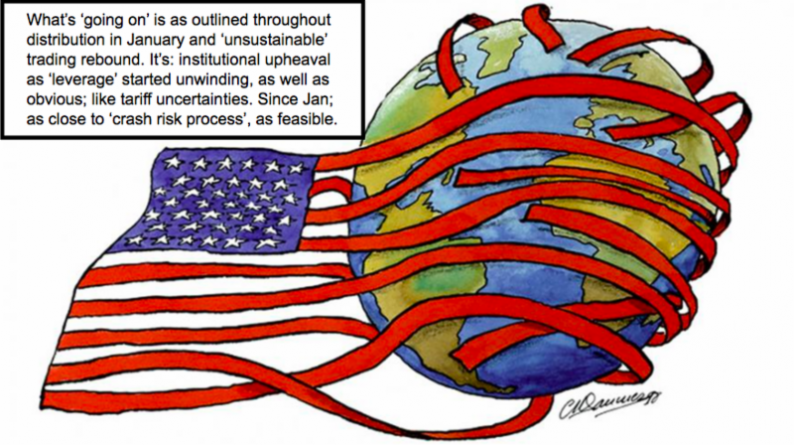

Upheaval conditions are neither magic, nor tragic for investors, at the same time the persistence of cheer-leading or resistance to realities by so many, was almost mystical. Most have acknowledged declines (how can they not?), but few saw the handwriting on

March 25, 2018