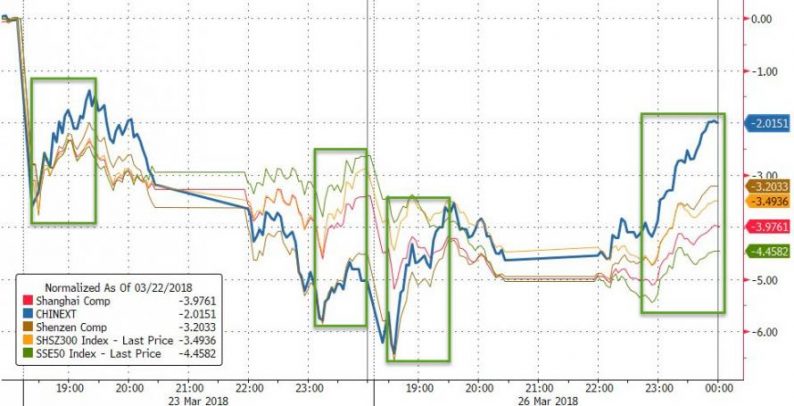

A full-court press weekend of press by WH officials (Mnuchin gushing hope) and sure enough… a big bounce in stocks… Video length: 00:00:19 China stocks rebounded in the afternoon session (National Team again?) But European stocks bloodbath’d below Friday’s lows…

March 26, 2018