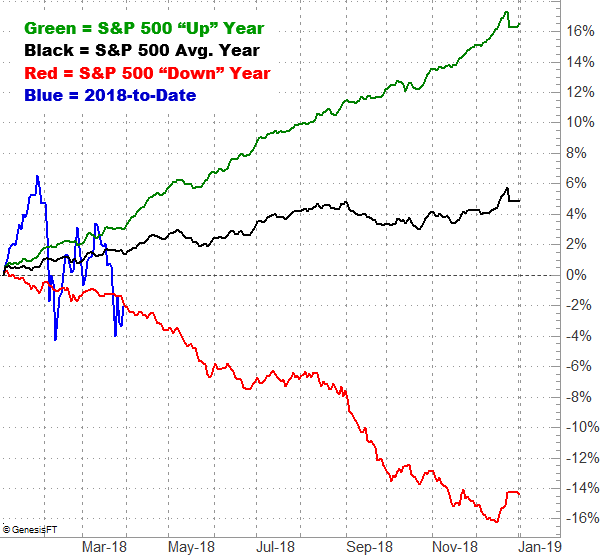

AT40 = 38.7% of stocks are trading above their respective 40-day moving averages (DMAs)AT200 = 42.4% of stocks are trading above their respective 200DMAsVIX = 20.0Short-term Trading Call: neutral Commentary The bears did their best to spook the market, but they failed to

April 1, 2018