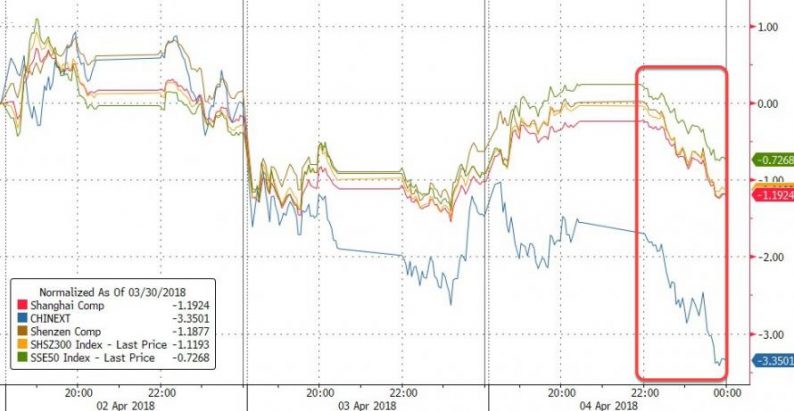

The choppy conditions spread across all three sectors today with volatility from Australia to America. The only common theme today appeared to be volatility, resulting in the rejection of both large gains and losses! The ASX recovered from a very

April 4, 2018

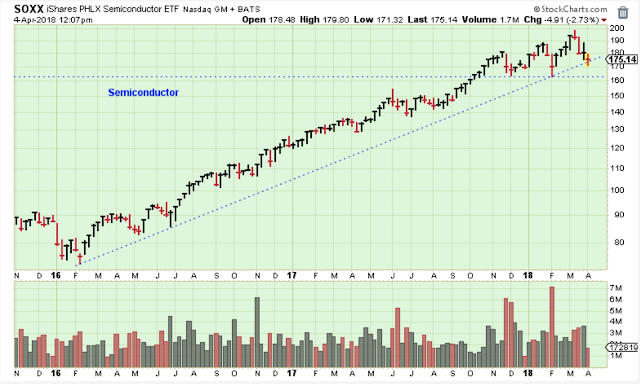

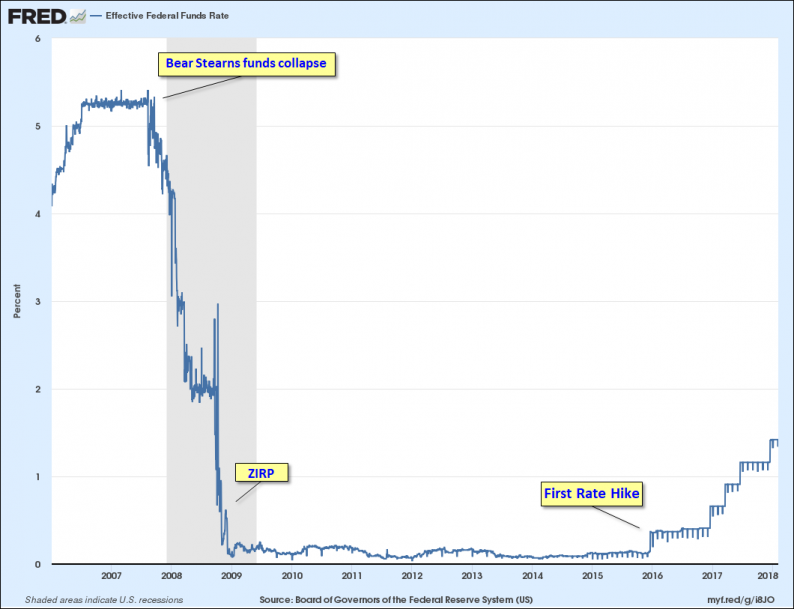

Our monthly market valuation updates have long had the same conclusion: US stock indexes are significantly overvalued, which suggests cautious expectations on investment returns. In a “normal” market environment — one with conventional business cycles, Federal Reserve policy, interest rates and inflation