“China’s reaction to Mr. Trump’s legitimate defence of the American homeland has been a Great Wall of denial – despite incontrovertible evidence of Beijing’s illicit and protectionist behaviour. Instead, China is attacking American farmers with the threat of retaliatory tariffs

April 11, 2018

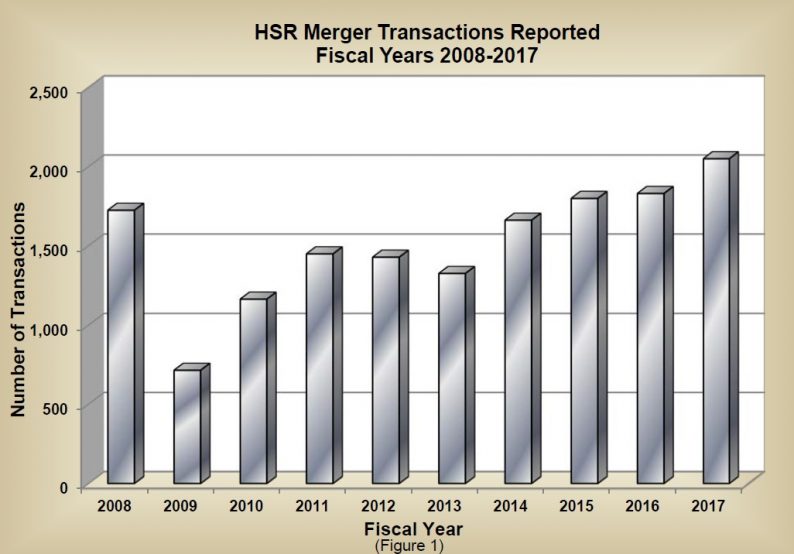

Each year the Federal Trade Commission and and the Department of Justice Antitrust Division publish the Hart-Scott-Rodino Annual Report, which offers an overview of merger and acquisition activity and antitrust enforcement during the previous year. The Hart-Scott-Rodino legislation requires that all