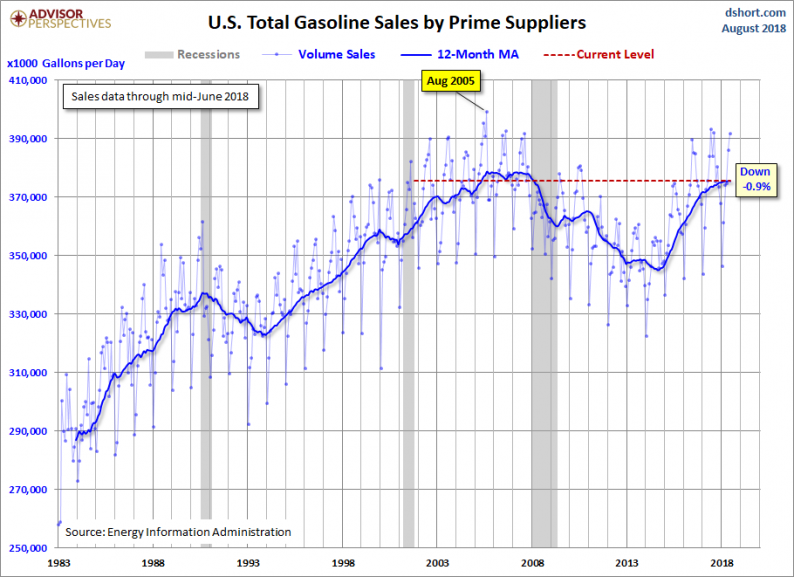

The Department of Energy’s Energy Information Administration (EIA) monthly data on volume sales is several weeks old when it released. The latest numbers, through mid-May, are now available. However, despite the lag, this report offers an interesting perspective on fascinating aspects of

August 21, 2018