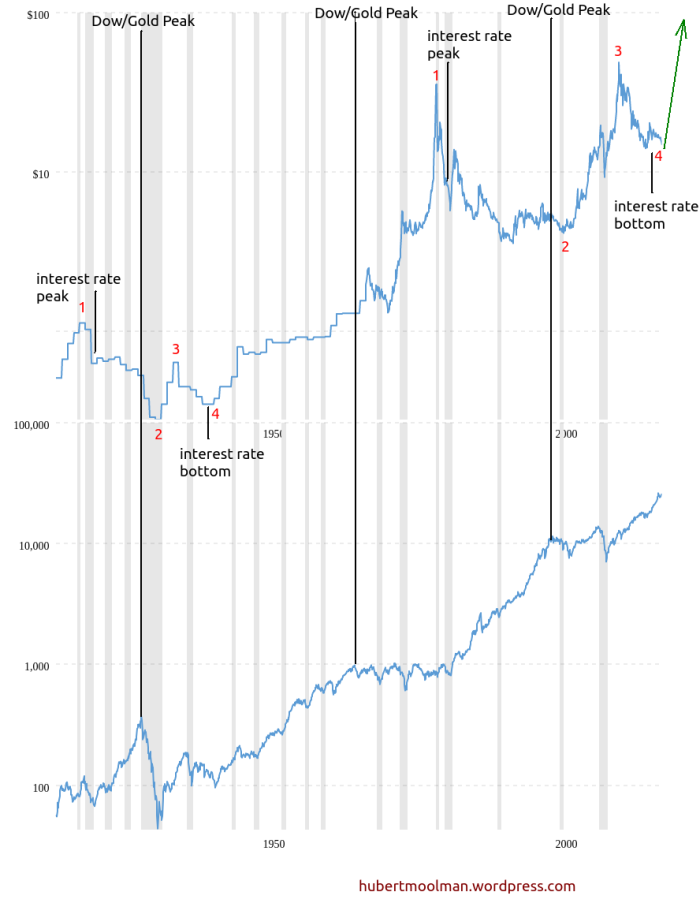

Back in April, I penned an article laying out 10-reasons why from a fundamental and technical perspective the bull market may have ended. To wit: “I think the 9-year old bull market may have ended in February. I could be wrong. Actually,

August 28, 2018

Clinical-stage biopharma Immunomedics (Nasdaq:IMMU) is a heavyweight player soaring in the worldwide antibody-drug conjugate (ADC) market. In other words, IMMU specializes in cancer therapies; and it’s been a standout year for investors. Notably, IMMU’s lead investigational ADC is IMMU-132 (sacituzumab