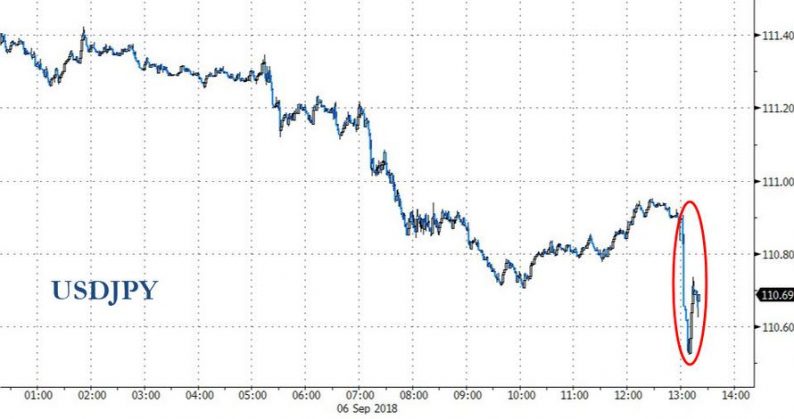

USD/JPY dived after hours (following a day of weakness) after reports from The Wall Street Journal that President Trump told a columnist that he will take his trade fights to Japan next. Yen strengthened as safe haven carry flows reverted home on the

September 6, 2018