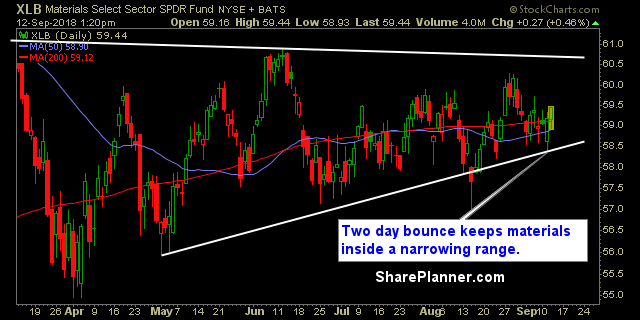

Sectors as a whole remain bullish, despite recent market pullback. The two sectors that I like the least are the financials and the materials. Both of them look problematic, and the financials are showing more weakness today, despite already being

September 12, 2018