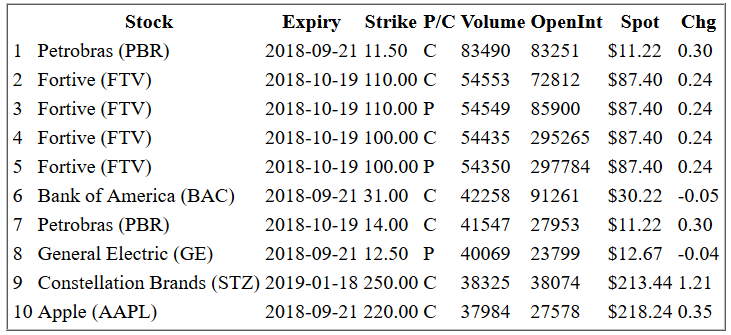

It’s not getting much airplay, but on Friday, a rather important factor to the incessant U.S. financial asset bid expired. According to Bloomberg’s Brian Chappatta, Friday was the last day U.S. corporations could deduct pension contributions at the 2017 corporate tax

September 18, 2018