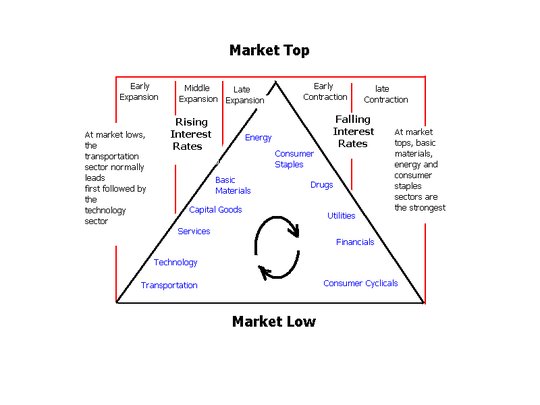

Until the last couple of weeks, net speculative positioning in financial markets was all on one side of the boat with speculators are woefully unprepared for a major risk-off event, suggesting complacency had reached epidemic levels as equities broke out to new highs. Then

October 21, 2018