Stocks put in another ‘pop and flop’ kind of day, finishing nearly unchanged after a ranging day of highs and lows that were remarkable. This is not bullish, and not a constructive action for equities. Bully better hope that nothing

November 2, 2018

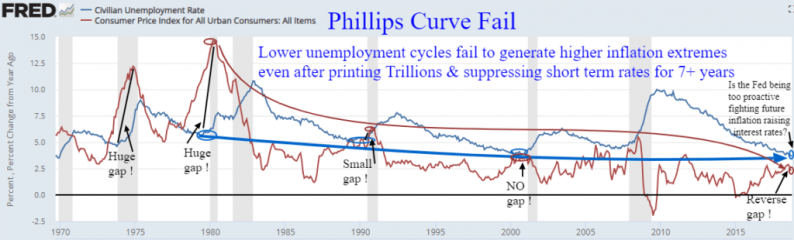

Our October report reviewed the limitations of the Phillips Curve in forecasting inflation as it relates to unemployment. Essentially economists interpretation of Phillips posit that lower unemployment equates to higher inflation. This view was created in the 1970’s post Gold/Currency Standard during the