It was a good week for the S&P 500 (SPX) jumped almost 2.7% over the previous week. The index closed the fourth week of April 2024 at 5,099.96.There were three main drivers behind the positive change from the preceding week:

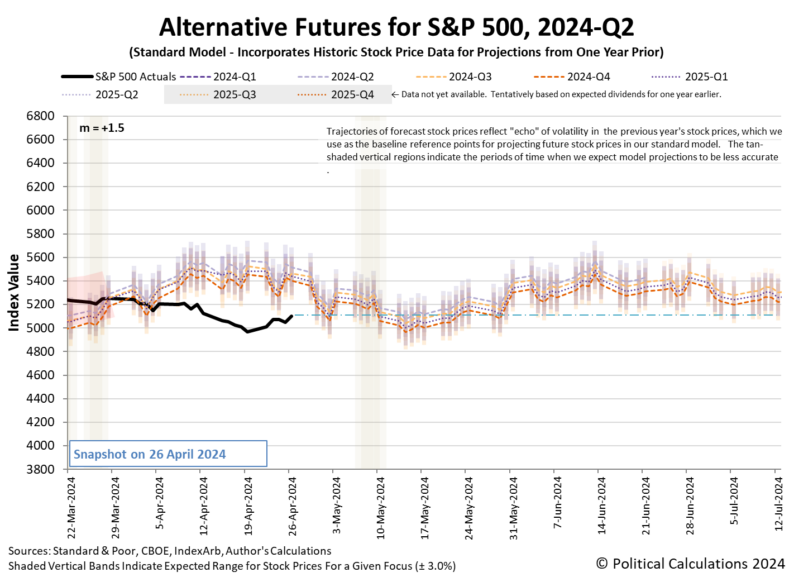

We think that last development to prompted investors to shift their forward investment horizon from 2024-Q4 back toward 2024-Q3. Here’s the latest update of the alternate futures chart. latest updateHere are the week’s other market-moving news headlines:Monday, 22 April 2024

- IMF’s Gopinath says high U.S. deficits fueling growth, higher interest rates

- US consumers on lower incomes face loan stress while banks pull back

- Fed hawks and doves: US central bankers see ‘no urgency’ to cut

- Souring China dreams force Western financial firms to cut costs

- China’s state planner warns intensified EV price war on oversupply

- China’s Q1 fiscal revenue falls as tax cut policies weigh

- BOJ to project inflation will stay around target, signal chance for rate hike

- Middle East tensions should not delay ECB’s June rate cut, Villeroy says

- ECB governors fear political pressure over Fed-style ‘dot plot’

- Wall St stocks end higher with major corporate earnings in view

Tuesday, 23 April 2024

- US business activity cools in April; inflation measures mixed

- Oil falls back after robust EU data as Mideast tensions linger

- Shortages key to copper’s upward price trajectory to new peaks

- US new home sales rebound to six-month high; rising mortgage rates a concern

- BOJ will hike rates if trend inflation accelerates, gov Ueda says

- Yen’s slide toward 160 level could trigger action, says senior ruling party official

- Japan may intervene to support yen any time, says senior ruling party official

- Japan issues strongest warning yet on readiness to intervene in currency market

- ECB governors stick to plan for multiple rate cuts despite global headwinds

- June ECB rate cut firmly in play; but slower easing now expected

Wednesday, 24 April 2024

- Slow, but solid US economic growth anticipated in Q1; inflation likely heats up

-

Oil settles lower as U.S. business activity cools, concerns over Middle East ease

- US refiners’ profits to fall from last year but margins remain strong

- Country Garden allowed to postpone first payments on three onshore bonds

- Exclusive: China turns the heat up on cross-border investments in local govt debt, sources say

- Yen’s slide toward 160 level could trigger action, says senior ruling party official

- ECB should be very cautious about post-June rate cuts, de Guindos says

- S&P 500 ends higher as markets weigh rising yields, upbeat corporate results

Thursday, 25 April 2024

- Q1 US GDP shows surprise slowing and uncomfortable inflation

- Oil eases as US demand concerns outweigh Middle East fears

- Confounding US economic, inflation data muddy Fed’s rate path

- Weak GDP, strong prices, highlight Fed dilemma

-

Fragile yen could make BOJ’s Ueda tilt more towards hawkish stance

- Explainer: What would Japanese intervention to boost a weak yen look like?

- The yen has a yield problem the BOJ can’t easily fix

- ECB most concerned about wages, services, Schnabel says

- ECB should not only target inflation, Macron says

- Meta sparks tech selloff as AI splurge spooks Wall Street

- Wall Street stocks fall as weak GDP growth spreads rate-cut gloom

Friday, 26 April 2024

- US inflation increases moderately; consumer spending boosts Q2 outlook

- now looking much less shaky

-

BOJ keeps low rates, hints of future rate hikes fail to stem yen fall

- Instant view: Bank of Japan keeps rates steady, tweaks JGB-buying language

- Japan frets over relentless yen slide as BOJ keeps ultra-low rates

- Microsoft results top Wall Street targets, driven by AI investment

-

announced it would initiate a dividend

- Google parent Alphabet reclaims spot in $2 trillion valuation club

- S&P 500 Q1 earnings estimated growth improves; stocks up for week

The U.S. Bureau of Economic Analysis’ first estimate of the real GDP growth rate in 2024-Q1 is +1.6%, well below the +2.9% growth rate forecast by the Atlanta Fed’s GDPNow toola week ago. The BEA will revise its GDP growth rate estimate twice during the next two months. In the meantime, the Atlanta Fed’s GDPNow tool has turned its forward-looking focus to how fast real GDP will grow during 2024-Q2 with an initial forecast of +3.9% growth for the quarter.More By This Author:How Long Might It Take A Hacker To Crack Your Password By Brute Force In 2024? Climbing Limo GDP Forecast For 2024-Q1″No Rate Cut” Bear Scares S&P 500 Into Retreat

Leave A Comment