The high yield landscape has been a difficult one to navigate over the last year. The pernicious selling in commodities combined with a rocky road for stocks has led to sliding prices in junk bonds, master limited partnerships, and mortgage REITs.

These asset classes have been pilloried for luring in yield-seeking investors, only to have the rug pulled out from under them as credit conditions deteriorated. Hopefully an important lesson has been learned – the higher the yield, the higher the risk of capital invested.

Those that were burned the worst may be taking the tact of avoiding these sectors altogether. However, monitoring exchange-traded funds that track high yield indexes can be a useful endeavor. They can often provide insight into underlying stock market or debt dynamics as well as serve up trading opportunities showing relative value characteristics.

Let’s delve into some of the most important high yield ETFs that should be on your radar.

iShares iBoxx High Yield Corporate Bond ETF (HYG)

HYG is the largest high yield bond ETF with $16.7 billion in total assets. This passively managed index fund owns nearly 1,000 corporate bonds of companies with below-investment grade credit ratings. These types of fixed-income instruments are often referred to as “junk bonds” because of their lower quality credit fundamentals.

Investors who own a basket of junk bonds like HYG are nominally compensated for the higher risk by receiving a much higher yield than Treasuries or investment-grade corporate bonds.HYG currently has a 30-day SEC yield of 6.96% and income is paid monthly to shareholders.

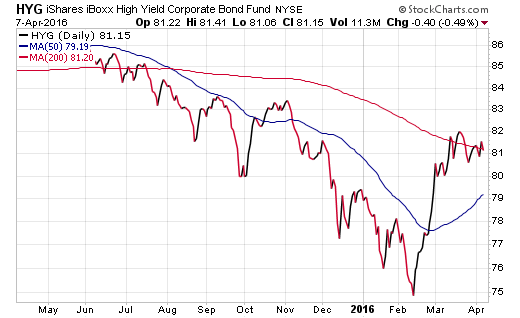

A peek at the chart below shows how HYG broke below its 200-day moving average nearly nine months ago and has been in a persistent down-trend ever since. This ETF was down over 20% from high to low, but managed to claw its way back from the abyss during the February and March rally in risk assets.

The important question now is whether HYG is consolidating for another push higher or is it getting ready to rollover once again?

Leave A Comment