As the euro continues to drift lower, it has become the accepted wisdom that we are headed for parity with the dollar.

Source: barchart.com

Indeed it is widely expected that the ECB will expand its securities buying program in size, duration and scope (the ECB has been exploring buying municipal bonds for example). The central bank is also expected to cut the benchmark rates, pushing deeper into negative territory. The chart below shows the Euribor futures trading significantly above par as the market expects sharply lower interbank rates.

Source: barchart.com

This of course differs sharply from the monetary policy in the US where markets now assign 70%+ probability of a rate hike next month (as discussed here back in October). There is no question that such divergent policy trajectories should push the dollar lower. But has a great deal of this divergence been priced into the markets?

As the Euribor chart (above) shows, the market could now be “priced to perfection”. The expectations for a “bazooka” new stimulus from the ECB are also manifested in the record low Eurozone bond yields. For instance, here is Germany’s 5-year government bond yield – clearly pricing in much more demand ahead.

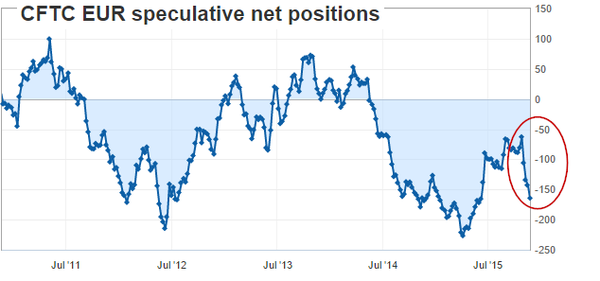

These expectations have resulted in the short euro position becoming a crowded trade once again. The chart below shows speculative accounts’ net euro futures positions. What happens if the announcement from the ECB is not quite the “shock and awe” markets expect?

Source: Investing.com

What could push the ECB to come out with a more modest stimulus increase? Here are some possibilities.

1. In spite of the VW scandal and the Paris attacks, German business sentiment remains strong. The Ifo industrial sentiment exceeded economists’ forecasts while the service sector climate hit record highs (below). While the China slowdown certainly created a drag on German GDP growth, the impact has not been as severe as many economists were expecting.

Leave A Comment