The global markets were humming right along until a large crack appeared in 2015. This big crack in the global economy seemed to go unnoticed, however the implications are quite serious if the trend continues.

Actually, I had no idea how significant this development was until I compared the data to what took place during the financial and economic crash in 2008-2009.

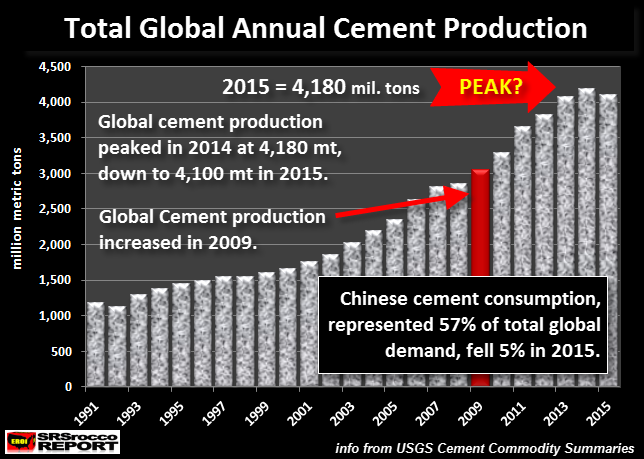

According to the USGS – U.S. Geological Survey, rapidly rising global cement production reached a peak of 4,180 million tons in 2014, and then suddenly declined in 2015:

While a drop of 80 million tons in 2015 isn’t a huge amount, when compared to the data in 2009, it’s a significant trend change. Let me explain. The World Bank just revised their figures showing global GDP (Gross Domestic Product) declined 5.7% in 2015:

When they first came out with their figures, the World Bank reported that global GDP declined from $78.4 trillion in 2014 to $73.9 trillion in 2015. As we can see they revised each figure up by $200 billion, but the overall decrease in GDP was still 5.7%. Regardless, the interesting thing to focus on is that during the U.S. and Global financial meltdown in 2009, the world GDP fell less in percentage terms at only 5.2%.

Now, if we look at the Global Annual Cement Production chart above, we will see (shown as a RED BAR) that global cement production increased by a stunning 7% in 2009. Global cement production jumped from 2,850 million tons in 2008 to 3,050 million tons in 2009. This was mainly due to a large increase in Chinese cement production.

As the chart also shows in the lower right hand side, Chinese cement production accounted for 57% of the world’s total in 2015. Furthermore, the decline in global cement production was mainly due to a 5% drop of Chinese cement production that year.

The reason for the big drop in global GDP in 2015 and resulting decline in world cement production was due to the 47% collapse in the price of a barrel of oil. This had a serious impact on the global markets… and still does. Even though the oil price has risen recently, it declined another 17% in 2016 compared to the previous year. I would imagine this should impact 2016 global GDP negatively as well. We will just have to wait and see what the figures turn out to be when the World Bank releases them in the next several months.

Leave A Comment