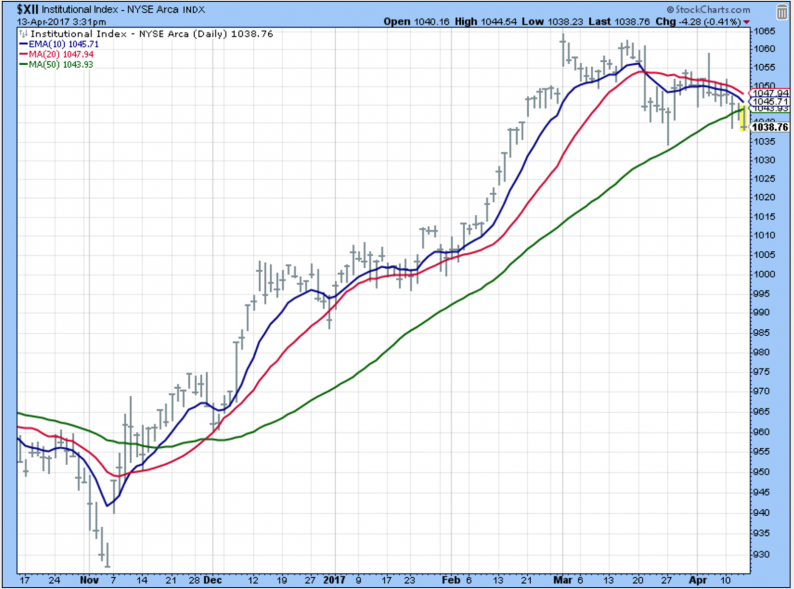

The general market finally followed its own leading breadth indicators lower today. This chart confirms that the downside of the medium-term trend is underway.

Here is a look at the dates that show the turn-up and down for the cycle.

Here is a look at the short-term. A new downtrend started yesterday, and it looks like today’s selling confirms yesterday’s start of the downtrend.

A spike in the VIX is a bit scary meaning there is a sell-off underway. But then again, the spike is also the signal that a buying opportunity is coming soon.

The Leader List

The leader list is now full of defensive sectors as the market enters a correction.

Latin America, ILF, dropped off the list today.

My guess is that Tech and the NAS-100 will drop off early next week.

We’ll know when the market is ready to bottom out because we will start seeing the cyclical and growth areas start to pop back into leadership.

Biotech was very strong today. Who knew biotech was the new safety trade?

Here is a look at the small caps biotechs.

Here is a look at today’s breakdown for Latin America.

I am taking the three-day weekend off from all stock market-related news and charts! Yeah! See you Monday.

Outlook

The long-term outlook is positive.

The medium-term trend is down as of March 21

The short-term trend is down as of April 12

Leave A Comment