Knowing why an investment strategy has stumbled is just as important as recognizing why it succeeded. This obvious-but-often-unheeded bit of wisdom comes to mind after reading yesterday’s Bloomberg story that seven large, public US university endowments posted disappointing results for the year through the end of June 2016. “It was a bit of a bloodbath,” said Jagdeep Bachher, chief investment officer at the University of California system. The weakness is surprising because the year through the end of this year’s first half generated a modest upside bias for the Global Market Index (GMI), an unmanaged benchmark that holds all the major asset classes in market-value weights.

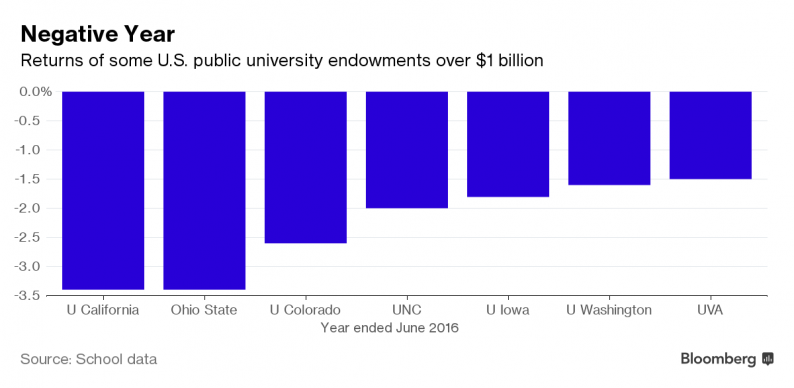

But that upside bias was nowhere in sight for the endowment funds, as a chart in the Bloomberg article reminds.

You can’t tell much from one-year returns, of course—especially for portfolio strategies run by endowments. These tend to be complicated beasts, which is probably the source of the trouble. In any case, crunching the numbers across various time windows and focusing on multiple risk dimensions is essential for understanding what’s going on. That said, there are legitimate issues of concern when a strategy falls well short of a simple benchmark that, in theory, is a reasonable yardstick for an investment mandate.

With that in mind, GMI posted a 1.2% total return for the 12 months through June 30, 2016, as originally reported here. That’s a weak result, but the source of GMI’s weakness for that period is clear: low and negative returns in the passive benchmark’s major allocations, particularly for foreign stocks. For perspective, let’s review the table of performance data for GMI’s components at that point in time.

Note, too, that an ETF-based version of GMI (GMI.F) was also higher by 1.2% for the year through this past June 30. Flat-to-modestly higher results over that span can also be found in publicly traded asset allocation products. The Vanguard Star fund (VGSTX), for example, posted a fractional gain for this 12-month period, although just barely. But if this low-cost, plain vanilla mutual fund with a global asset allocation mandate can keep its head above water, why can’t endowments with sophisticated oversight deliver comparable results?

Leave A Comment