The problem with exchange rates is that they don’t always tell us anything about what everyone seems to think. In fact, the more wholesale financial exhibitions in a particular currency, the less traditional interpretations conform. In many ways, this is very much like transitioning between classical physics in the Newtonian, deterministic paradigm into quantum physics’ often strange and seemingly incoherent probabilism. What was once in a more traditional setting an easy determination to make (capital flows and such) is opened up instead to utter complexity and an entire range of inner workings that are difficult to comprehend even for seasoned observers.

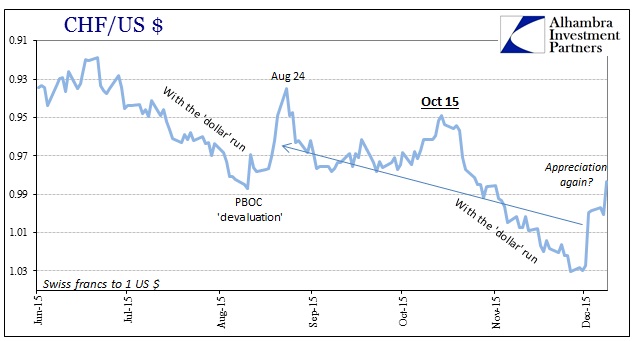

With more recent liquidations on offer in a broad range of financial spaces, and I mean far more than financial securities as suddenly financial disarray has become real balance sheet restructuring, certain currency movements that might defy the traditional fall into line of the wholesale dynamics. Right now that would apply most to the Swiss franc, which starting last week suddenly shifted away from the devastating depreciation that has plagued it for the past year and a half and back into an exhilarating countertrend that has developed in correlation with some of the worst conditions of late.

Again, it isn’t surprising to see junk bonds, oil, commodities and even stocks (today’s reversal included) struggle as the franc reverses toward appreciation. In one sense calling it “flight to safety” has purpose, but it might be better classified as global tabling of risk parameters and balance sheet offer (given the central function of Swiss banks in the eurodollar universe). Gold offers further evidence on that point, having itself behaved very much in line with the franc – particularly since October 15.

Gold, in its duality, had sunk to $1,050.60 on December 3 before following the franc upward; again, hedging for greater risk or the safety bid overwhelming in both franc and gold the downward pressure placed on it from general funding illiquidity.

Leave A Comment