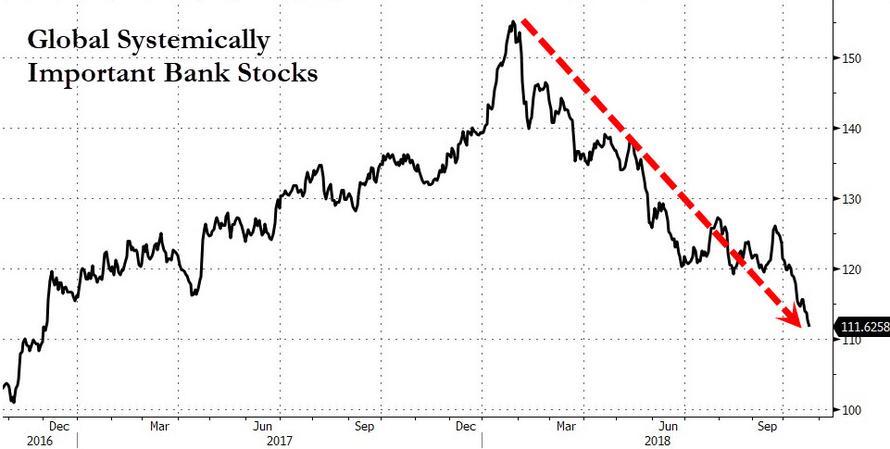

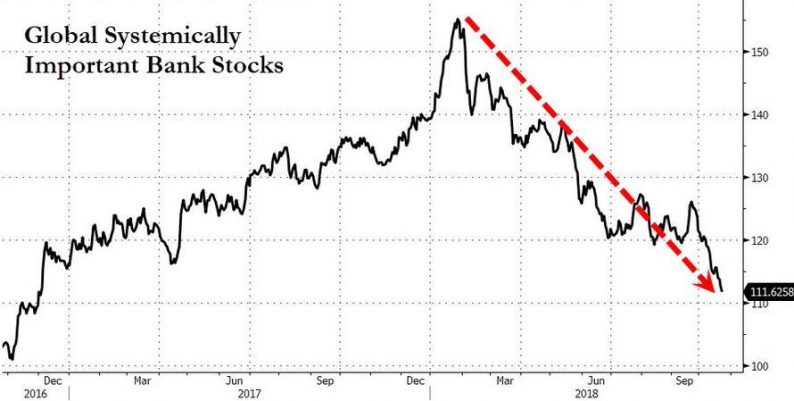

October was a rocky month for stocks and banking shares were no exception, with analysts pointing out that shares crashed hard, mimicking a pattern that surfaced in the immediate run-up to the financial collapse ten years ago.

And as the banking sector emerged as one of the worst performers during a brutal month, as they often do, Deutsche Bank shares stood out as one of the worst performers as shares tumbled to all-time lows for the first time in roughly two years following a disappointing earnings report, reigniting perennial fears that the bank would need to be broken up or bailed out, even as rumors about a possible merger with Commerzbank continued to circulate. Making a bad situation that much worse, what was formerly one of the bank’s largest shareholder, Chinese conglomerate HNA, has been dumping its shares amid a spate of government-ordered deleveraging.

But as HNA dumped, it appears another institutional investor has stepped up to take the other side of the trade, sensing that, under a layer of dysfunctional management, there is hidden value there, particularly in DB’s retail and trade-finance operations. As the Wall Street Journal reported, Hudson Executive Capital LP, led by former JP Morgan Chase & Co. finance chief Douglas Braunstein, has taken a 3% stake in the German lender – effectively taking the other side of the trade from HNA – cementing the activist fund’s status as a top-five shareholder.

Braunstein told WSJ that his trust in DB’s turnaround plan stems from his confidence in the bank’s new chief executive, Christian Sewing, a longtime employee who was brought in to replace John Cryan earlier this year. Since Sewing has taken over, the bank has failed a Federal Reserve stress test and paid a more than $500 million fine over its involvement in a $10 billion Russian money laundering scandal. But that hasn’t dampened investors’ hopes that the bank’s turnaround man du jour might finally be able to produce some tangible results. As he told WSJ, the activist investor believes DB is taking “the right steps” to facilitate the badly needed turnaround.

Leave A Comment