In early July, the Bank of Japan may or may not have contemplated the mother of all “stimulus.” Rumors began to fly that the Japanese central bank was, in fact, seriously considering an actual monetary helicopter as a way to boost flagging confidence rightly suspicious of any more QQE (or NIRP). We won’t know for some time (when the meeting transcripts are released in the future) whether BoJ was truly contemplating the idea, but whether it was or not the rumors had the intended effect (which I believe raises the likelihood that the central bank was involved in them).

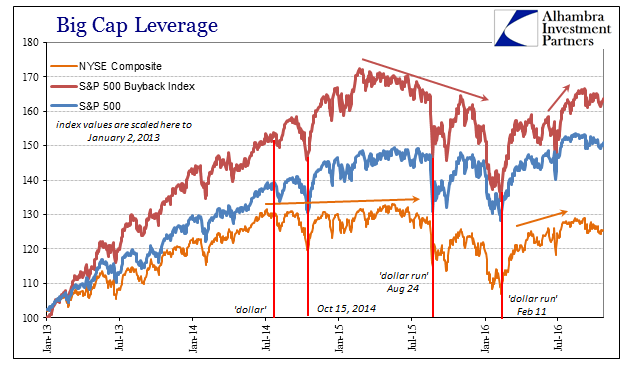

It wasn’t just Japan that felt the kick of possibly different “stimulus.” US stocks, for example, had hit a rough spot in the wake of the Brexit vote. It was short-lived bearishness, as once the potential “helicopter” was added into the mix of factors the S&P broke to a new record high, with other stock indices similarly intrigued. That euphoria was also short-lived, however, as since then the market seems far more unsure what all this might actually mean. In fact, since August and early September, stocks are overall slightly lower if still mostly sideways.

It isn’t just the stock market as other parts of other markets have joined in the glow of “helicopter” and like possibilities. Inflation expectations which had sunk near or to new lows suddenly reversed. After rising in September, breakevens are at the upper end of a range that has lasted since last summer when all this “global turmoil” first broke.

Of course, the bond market sold off and the yield curve steepened somewhat, too, though not in direct connection to the whispers of early July. Despite that, what I think is most convincing of these effects is the eurodollar curve. Eurodollar futures are mostly sideways but slightly higher (price) since the BoJ gossip. That was a clear break in the prior trend which had been the resumption or continuation of the prior upward track (bid). From the time CNY began to fall in its third strike of the ticking clock until the start of July, the eurodollar curve shriveled and flattened just as it had in all the worst parts of the past few years.

Leave A Comment