What Will Firms Do With The Extra Cash?

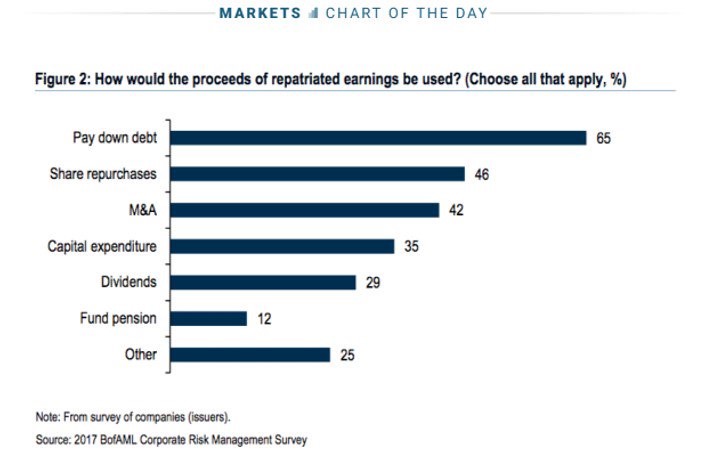

With the tax cuts passing today, there have been some firms announcing pay increases and investments. It’s easy to get caught up in anecdotal evidence from headlines. The chart below gives you a more complete picture of what firms are likely to do with the extra money. It shows what firms said they would do with the repatriated cash. Clearly, some mentioned a few options because the results add up to more than 100%. It’s not surprising to see funding pensions at the bottom of this list because unlike public pensions which are a disaster, private ones are well funded. The decision to pay down debt being at the top might signal that firms feel they have too much debt. The other way to rationalize this is firms have been issuing debt backed by the capital overseas to avoid paying high tax rates. Now that the cash can come back, firms are ending this process by paying back the debt they only issued because they couldn’t bring their earnings back home.

The GOP is hoping firms put money into capital expenditures like they are saying in this poll. The issue is whether firms have a place to invest the capital they are bringing back. That’s where regulation cuts come in. Less regulations will allow some firms to invest in places they couldn’t previously. Because the economy is growing quickly, it makes sense firms would reinvest capital back into their businesses.

Investment Grade Yields Can Increase

The analyst earnings expectations in the past few years up until this one all fell throughout the year. This was the first year where earnings came close to meeting estimates. As I mentioned previously, 2018 is looking even better as expectations have been increasing in the past few weeks. One thing to consider, which counters the narrative that S&P 500 earnings will be over $10 higher because of the tax cuts, is that higher yields mean firms will need to borrow at higher rates. This could cut into profits. A few months ago, it was questionable if firms like Apple would repatriate their cash because they pay such low rates on their debt. The situation still looks phenomenal for firms borrowing money, but the question is if it will go from great to good in the next year. BBB corporate bond yields have increased from 3.39% on September 7th to 3.63%. This is a small move, but if it keeps going higher like I expect, it will encourage more firms to repatriate their cash and use the money to pay off debt. Investment grade bonds should follow the increase in Treasury yields. As I mentioned previously, the 30 year bond has a lot of excess speculation in it on the long side.

Leave A Comment