When it comes to high-yield stocks, few companies offer higher income than mortgage REITs such as Annaly Capital Management (NLY).

However, it’s vitally important for dividend investors to realize that this industry is one of the hardest to consistently profit from, for numerous reasons.

Let’s take a closer look at Annaly Capital, one of the most popular mREITs, to see if this high dividend stock should be considered by those who need secure and dependable dividend income, such as retirees.

Business Description

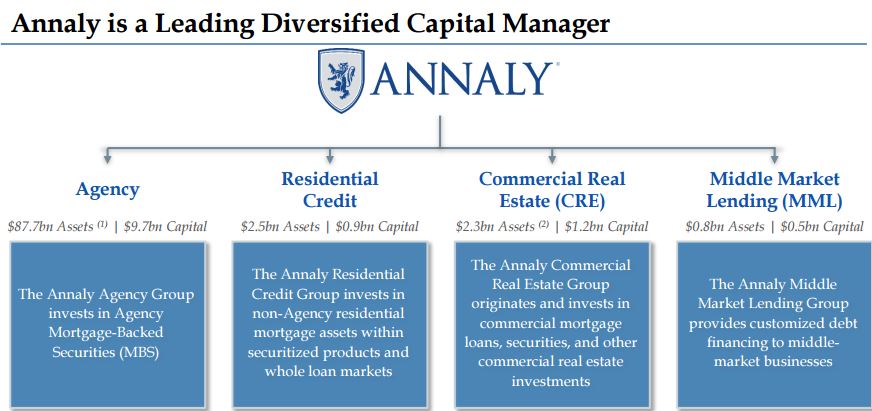

Founded in 1997 in New York City, Annaly Capital Management is the by far the largest and oldest mREIT in America with over $12 billion in assets, which it primarily invests in residential mortgages that are guaranteed by Fannie Mae and Freddie Mac.

Like all mREITs, Annaly’s business model involves borrowing at short-term (lower) interest rates, in order to fund the purchase of longer-term higher-yielding assets, mostly residential and commercial mortgage-backed securities (MBS).

The difference between these rates is the net interest margin, or “spread,” which Annaly pockets.

Combined with a high amount of leverage (6.4:1 as of the end of 2016), this strategy creates around a 10% levered return that generates the company’s profits.

Source: Annaly Capital Investor Presentation

Since REITs must payout 90% of taxable income as unqualified dividends in order to avoid paying taxes, mREITs have some of the highest dividend yields you can find on Wall Street.

However, while Annaly’s high yield of 10.6% might initially seem appealing, investors need to remember that in this age of record low interest rates, such generous yields don’t come without a large amount of risk in most cases.

In fact, the risks facing Annaly are significant enough that most conservative dividend investors are likely better off steering clear of the industry entirely.

Business Analysis

As you can see, Annaly’s financial results are very volatile. That’s because mREITs’ highly complex business model is one of the most interest rate sensitive in the entire U.S. economy.

Source: Simply Safe Dividends

One reason for the volatility is that Annaly’s net interest margin spread isn’t the only thing that determines how much money the company makes. There are a handful of other risks to consider with mortgage REITs.

Since Annaly is required to pay out almost all of its profits as dividends, it is reliant almost exclusively on accessing external capital markets, meaning debt and equity, to run its business.

Most of the company’s debt funding is from the “repo,” or repurchase market. That means that Annaly will temporarily sell some of its MBS to raise capital to buy others, with the promise of repurchasing them later for a higher price (the interest rate).

The repo market is tied to the London Interbank Offered Rate (LIBOR), which is itself tied to numerous central bank interest rates, including the Fed funds rate which is now rising.

As a result, when U.S. interest rates rise, Annaly’s funding costs rise with them.

However, because the majority of residential mortgage loans are fixed-rate, the interest they pay Annaly doesn’t change, eliminating any benefits Annaly could have from rising interest rates in the short term.

Long-term mortgage rates will eventually rise as well in this environment, increasing Annaly’s loan yields, but it takes time.

However, the problem for Annaly is that, because of the low yields on mortgages, especially those insured by the government (so-called agency MBS), the company needs to use a large amount of leverage in order to generate the kind of profits that allow it to keep paying its fat dividend.

Leave A Comment