Market participants are often heard saying things like “you can’t trade Gold on fundamentals.” With no cash flows to discount, Gold is a different animal than stocks or bonds. It is said to swing higher and lower due to changes in investor sentiment alone. Many a trader will advise you to simply follow the trend:

Going back to 1975 (when Gold futures began trading), how would such a strategy have fared?

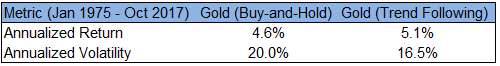

At first glance, pretty good. Owning Gold when it closed above its 200-day moving average and moving to cash when it closed below it would have resulted in a higher return (5.1% vs. 4.6%) with lower volatility (16.5% vs. 20.0%) than buy-and-hold.

The cumulative return for this trend following strategy: 752% versus 581% for buy-and-hold.

The maximum drawdown: 51% for trend following versus -69.6% for buy-and-hold.

Case closed, trend following wins?

Not so fast. We have yet to include the transaction costs that exist in the real world. The trend following strategy would have traded around 3.75 times per year going back to 1975. At a cost below 0.14% per trade, trend following still beats buy-and-hold. At anything above 0.14%, trend following underperforms.

While 0.14% may seem somewhat high in today’s world, for a long time it would have been deemed quite cheap (see chart below). It’s likely that the average transaction cost (slippage and commission) since 1975 was well above 0.14%. Which means it would have been difficult for trend following to beat a buy-and-hold strategy in practice.

Source: A Century of Stock Market Liquidity and Trading Costs, Jones (2002)

Does that mean trend following in Gold “doesn’t work”? It depends on what your definition of “work” is. If by “work” you simply mean a higher return, then that might be be an accurate assessment (if we include transaction costs). But looking back at history, the real value in trend following is not on the return side of the equation, but on the risk side. (Note: we showed something similar in our research paper on moving averages and leverage in the equity market).

Leave A Comment