![]()

AUD/USD trades near the monthly-high (0.7695), with the pair at risk of extending the advance from the previous week should the Reserve Bank of Australia (RBA) Minutes highlight a greater willingness to move away from the easing-cycle.

Even though the RBA remains in no rush to remove the record-low cash rate, the central bank may gradually alter the monetary policy outlook as Governor Philip Lowe warns ‘it is more likely that the next move in interest rates will be up, rather than down.’ A fresh batch of hawkish rhetoric is likely to trigger a bullish reaction in the Australian dollar as it stokes expectations for a 2018 rate-hike, and the aussie-dollar exchange rate may stage a larger recovery over the remainder of the year especially as the Relative Strength Index (RSI) breaks out of the bearish formation carried over from the summer months.

Keep in mind, the broader outlook for AUD/USD remains mired by the downward trend from September, but recent price action keeps the topside targets on the radar as the pair snaps the monthly opening range.

AUD/USD Daily Chart

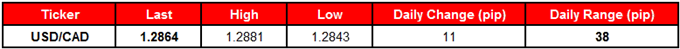

The series of failed attempts to break the monthly-high (1.2902) may continue to foster range-bound conditions for USD/CAD, with the par at risk of facing a near-term pullback as Canada’s Consumer Price Index (CPI) is anticipated to increase to an annualized 2.0% from 1.4% in October.

Leave A Comment