The energy markets are getting trounced lately, and it isn’t just oil that is getting hurt, gas, and methanol have been stumbling as well.Prices for oil, gas, and methanol have been tumbling as the markets have been oversupplied for the past several months.This oversupply has been felt in North America, Europe, and China which has put a big squeeze on these producers of energy.Due to the oversupply, falling prices, and sluggish demand Methanex Corp (MEOH – Analyst Report), is the Zacks Bear of the Day.

This Zacks Rank #5 (strong Sell) company is a Vancouver based company engaged in the worldwide production and marketing of methanol. Methanol, made from natural gas, is a basic chemical building block used to manufacture products such as formaldehyde, MTBE, acetic acid and others. The Company operates production facilities in Canada, the United States, New Zealand and Chile. The Company also markets additional methanol from plants in the US, Trinidad and Europe.

In their most recent quarter, the company saw 0% year over year earnings growth while revenues fell -27.8%.According to John Floren, President and CEO of Methanex, “Our third quarter Adjusted net income reflects lower average realized methanol pricing compared to the second quarter of 2015. Prices decreased as the affordability for methanol into certain energy applications moved lower relative to the second quarter, in alignment with lower oil and related product prices.”

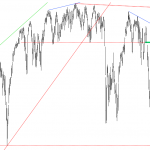

As you can see from the graph below, expectations MEOH’s stock price, and future expectations have been both declining for over a year.Even with a positive earnings surprise in Q3, the stock price has continued to decline.

Declining Estimates

Estimates for Q4 15, Q1 16, FY 15, and FY 16 have all seen significant decreases over the past 30 days; Q4 15 fell from $0.23 to $0.20, Q1 16 dropped from $0.50 to $0.21, FY 15 slipped from $1.28 to $1.24, and FY 16 plummeted from $2.69 to $2.10

Bottom Line

Methanex is facing a bleak Q4 and beginning part of 2016, because methanol remains oversupplied, and demand has remained sluggish.This situation might get some relief when the construction season begins, but that is several months away.Till then it would be best advised to stay away from the energy sector.

If you are inclined to invest in the Chemical Diversified sector you would be best served to look into Stepan Co (SCL – Snapshot Report), and or Koninklijke DSM (RDSMY – Snapshot Report).Each currently carries a Zacks Rank #1 (Strong Buy).

Leave A Comment