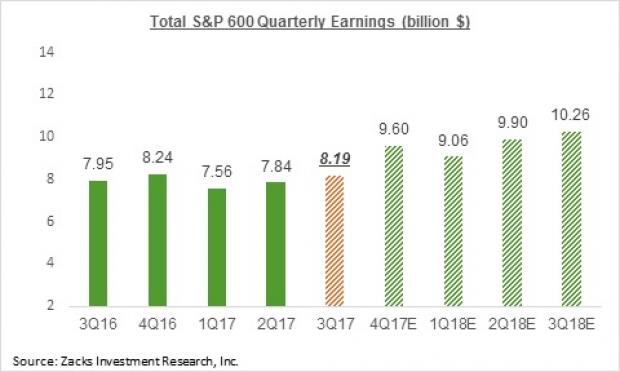

Small cap stocks are beginning to come out of a sustained downturn, and are expected to see double digit earnings growth over the next four quarters. Sheraz Mian, Director of Research at Zacks, wrote a detailed analysts of small caps (click here to read the full article) where he points out the previous struggles of small cap stocks, the recent turnaround, and future growth expectations. As you can see in the chart below, over the past year, the S&P 600 has struggled, but beginning in Q317, growth has returned and is expected to see a big jump for the next four quarters.

Sheraz comments, “What this chart shows is that the earnings outlook for small-cap stocks is at an inflection point, with growth expected to ramp up materially going forward. This will be a major change from what we have become used to seeing over the last couple of years. This should help support and drive small-cap stock prices going forward.”

Moreover, this growth is expected to boost total dollar earnings growth too, as you can see in the chart below.

It is also important to point out that these growth numbers are not accounting for any new tax changes. According to Sheraz, “One additional factor to keep in mind is that these favorable expectations don’t incorporate the impact of tax cuts that Congress is currently contemplating. Tax cuts will be a big boost for small-cap stocks, much more than is the case for large-cap stocks. The reason for that is the largely domestic orientation of these companies.”

Given all of this positive data, we wanted to identify the best small cap mutual funds to take advantage of this expected uptick in the sector. First, we started with the Zacks Mutual Fund Screener, and looked for funds that had at least 90% exposure to small cap stocks, a low expense ratio, no load fees, 1 year total return of +20% or better, and a Zacks Rank #1 (Strong Buy), or a Rank #2 (Buy). From the results, we picked the top 4 (out of 7 that met these criteria).

Leave A Comment