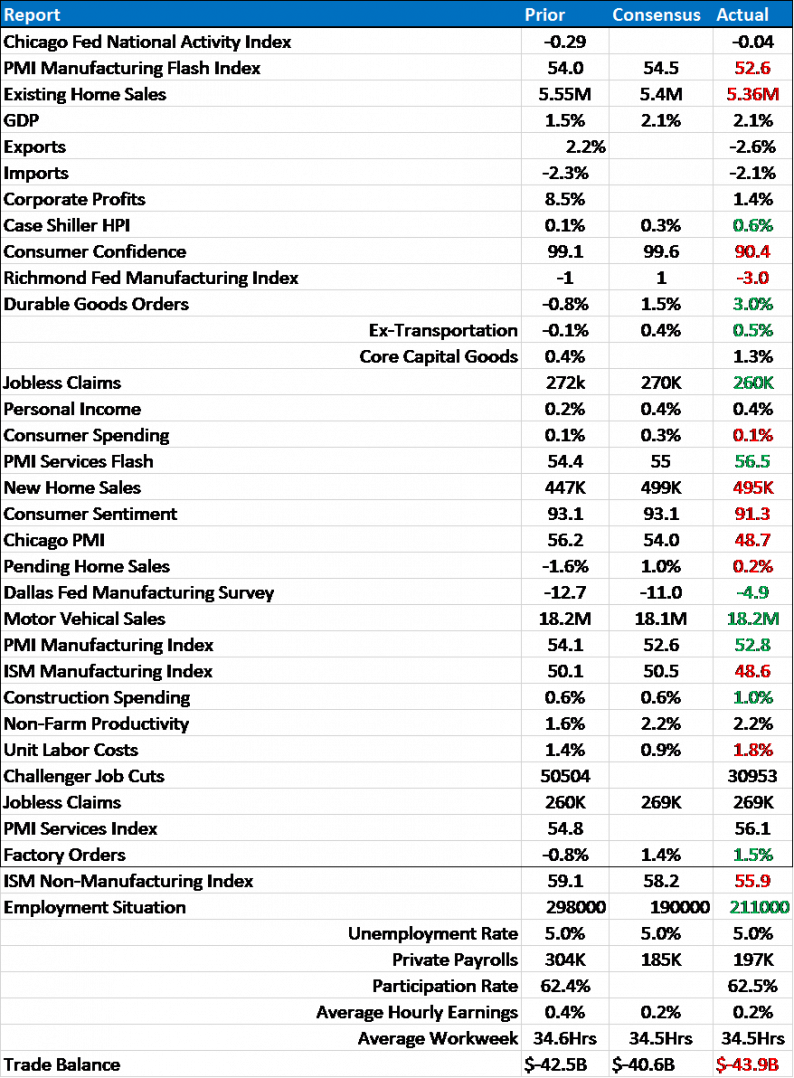

The incoming economic data continues to disappoint. The Citigroup Economic Surprise index set a record this year for the length of time it stayed in the negative column (data less than expected) of over 200 consecutive days. Even in the depths of the Great Recession we never had more than 100 consecutive days in negative territory. It is odd that economists have remained so optimistic – overly so – even as the data continues to defy their sunny outlook.

The trends that have been in place for over a year continue. The industrial/manufacturing economy is in recession and has been for months in my opinion. The ISM seems to confirm that but don’t take that to mean that a recession for the entire economy is right around the corner. The ISM track record on that is not great. In the past, when the ISM fell below 49 as it did last week, recession has followed in short order about 1/3 of the time. Recessions have started with the ISM above 50 (1969, 1974) but we’ve also had many times when it has dipped below 50 with no recession.

One thing that continues to amaze me is that this manufacturing recession is ongoing even with auto sales above 18 million SAR. Credit is obviously having an impact on auto sales and until that changes the sector will probably continue to boom. We won’t know the consequence of that until much later, probably during recession, but if you can wait, I’d say hold off on buying a car now. I will make the bold prediction that there will be a glut of used/repo cars available sometime in relatively near future. There was some improvement in Durable Goods orders last month but considering inventories I wouldn’t put a lot of faith in it.

One concerning development over the last couple of these reports is the slowdown in housing. It isn’t very deep yet and certainly can’t be called a trend but we’ve had two months now of soft data on new and existing home sales. Construction spending continues to be robust though, one of the few areas we can point to with double digit year over year change. Housing warrants a bit of extra attention in coming months though if the Fed is successful in hiking rates. It may be that they pulled forward some sales by telegraphing the rate hike for so long.

Leave A Comment