Earlier last week I did an instablog post walking through why M&A activity was likely to remain robust in the pharma and biotech sectors. I also invited readers to submit their picks of firms within the industry that they thought would make attractive takeout candidates. The column generated a lot of good conversation and numerous ideas were offered up such as Geron (NASDAQ: GERN) in the small cap space as well as mid-cap Isis Pharmaceuticals (NASDAQ: ISIS).

However, it was a follower’s suggestion of a tiny pain and addiction management drug maker

BioDelivery Sciences (NASDAQ: BDSI) that caught my eye. Its unique drug delivery technology that produces a thin film strip that melts in your month to deliver the proper dosage is intriguing. It reminds me of one of the reasons I bought Eagle Pharma (NASDAQ: EGRX) back in mid-December of 2014 before it quintupled this year in that way. Finally, given a standing collaboration and distribution deal it already has in place with a larger player in the industry that is a serial acquirer, it made the most logical near-term buyout target.

Company Overview:

BioDelivery Sciences International is a specialty pharmaceutical company based in Raleigh, North Carolina. The company engages in the development and commercialization of pharmaceutical products principally in the areas of pain management and addiction. The company provides its products based on its patented BioErodible MucoAdhesive (BEMA) drug delivery technology.

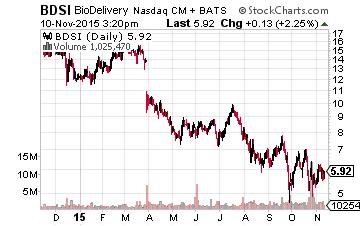

The stock has a market capitalization of just over $300 million, enough cash on hand to fund itself through at least mid-2017 and has one approved product on the market and one more on the way. It also has a couple of other products in its pipeline as well as some small but frequent insider buying in 2015. The stock trades at right around $6.00 a share. The equity traded at $18.00 a share earlier in the year.

Product Pipeline:

Leave A Comment