In the absence of a booming economy, one has been conjured from a select few employment statistics. The catalog, beginning in 2014, consisted of a rapidly falling unemployment rate, the Establishment Survey which dazzled with headline payroll growth supposedly adding up to the “best jobs market in decades”, and the JOLTS series (but curiously omitting everything but the Job Openings piece). Over the years since, the middle one has been quietly scratched from the list.

That leaves the unemployment rate which goes lower and lower way past where “full employment” was once thought to begin. And then Job Openings (JO) which go higher and higher well beyond what are supposed to be related data points.

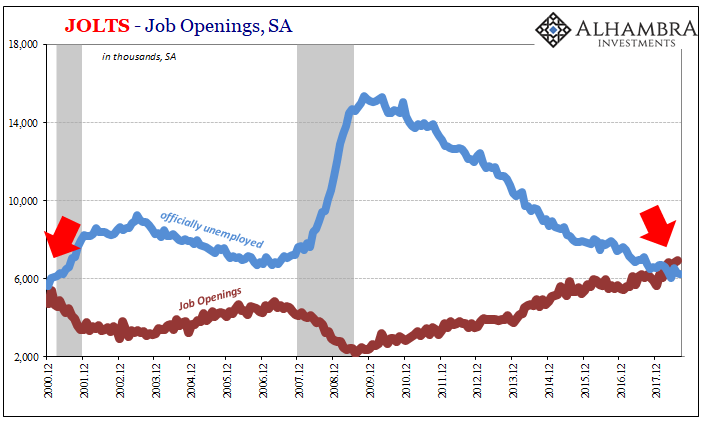

The latest talking point about JO is in relation to the number of unemployed Americans. For the past few months, there have been more job openings, according to the BLS’s definitions for them, than there are unemployed workers, also according to the BLS’s definitions for these. It makes for a terrific soundbite.

So long as you leave it there, the economy can be booming for the first time since the end of the dot-com era. Perhaps it is the best jobs market in decades?

The big problem is that companies are not hiring (HI) at anywhere close to the same level as they advertise for new positions, or to refill those that through the normal course of business (even in a stagnating economy) become available. The difference in just JOLTS between one view of labor demand (JO) and another perspective of the same factor (HI) has become a ridiculous extreme.

It’s been this way now for four years, ever since the data for JO surged in early 2014. While it may have been consistent with the slope of the decline in the unemployment rate, it wasn’t in relation to anything else – including, as we know, the slowdown evident in the Establishment Survey following the near recession in 2015-16. That downturn barely registers in JO.

Leave A Comment