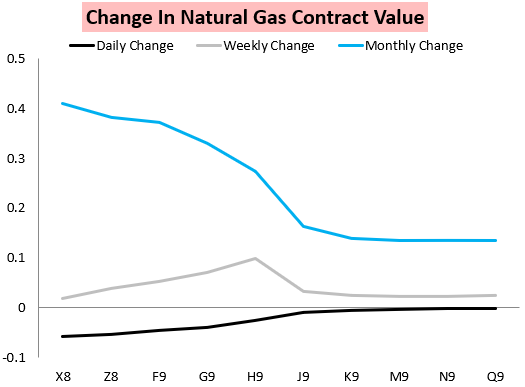

The November natural gas contract whipsawed around quite a bit this week, shooting higher on Monday and setting a new high for the week on Tuesday before re-testing it Wednesday. From there prices attempted to decline Thursday, bouncing into the settle but following through on that downside with a 2% decline Friday to settle up only around half a percent on the week.

Gains were larger further along the strip, with the March natural gas contract actually logging the largest gain (9.8 cents) of the week.

We saw bull spreads that were put on last week and Monday quickly unravel through the week, as seen here with the X/F November/March contract spread.

Spreads originally narrowed on very strong cash prices early in the week that combined with bullish weather forecasts to blow out the front of the strip. However, through the week we saw cash prices begin to ease as power burns pulled back in the South.

Despite quite a bit of intraday volatility, the week actually fit our expectations.

Those storage concerns references were partially eased by an in-line EIA print Thursday that continued to show a market that was far looser than a few weeks ago.

We saw colder afternoon models push prices up into the settle.

Leave A Comment